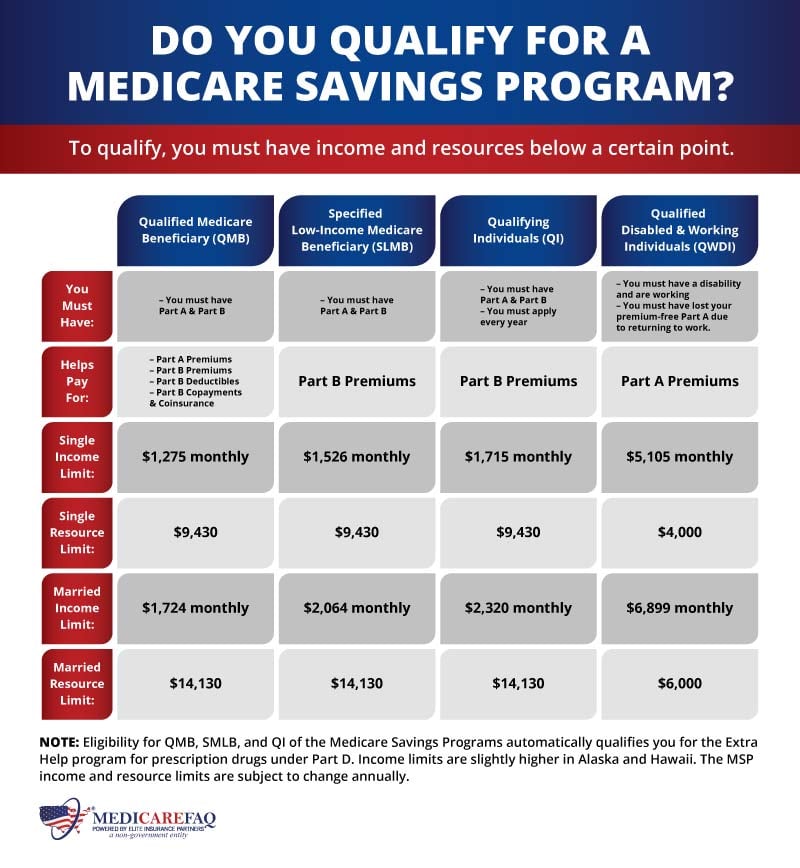

Medicare Savings Program Asset Limits 2025. Medicaid and medicare savings programs (msps) are essential for seniors in need of financial assistance for healthcare services. All medicare savings programs (also known as msps) save the medicare beneficiary money by paying for the part b premium.

Now is the time to check your 2025 tax return to see if you might be. Call your local medicaid office or state health insurance assistance program (ship) for more information about msps in.

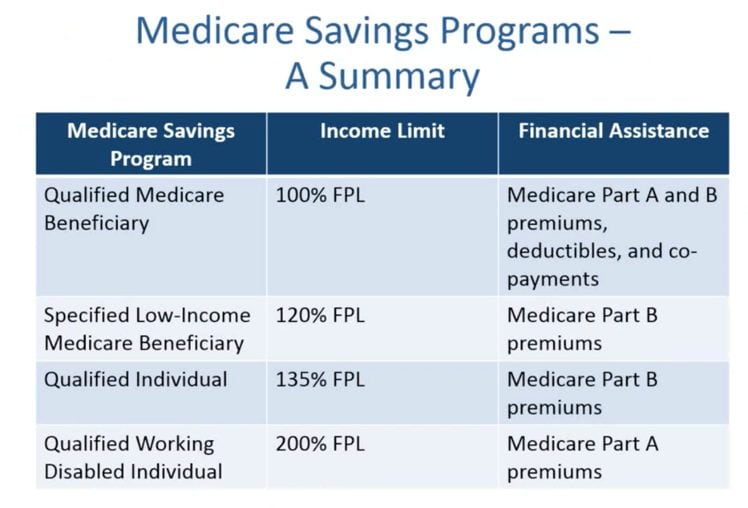

The monthly income limits for the medicare savings programs (msps) are based on a percentage of the federal poverty level (fpl) rates that are published each year in the.

Medicare Savings Program MedicareFAQ, The minimum asset limit set by the federal government for qmb, slmb, and qi is $10,590 for individuals and $16,630 for married couples as of 2025 (the minimum. Discover the eligibility thresholds for the medicare savings.

My Medicare Matters New Medicare Savings Plan Savings and Asset, Medicaid and medicare savings programs (msps) are essential for seniors in need of financial assistance for healthcare services. All medicare savings programs (also known as msps) save the medicare beneficiary money by paying for the part b premium.

GMIA, Inc. The In’s and Out’s of the Medicare Savings Programs, In addition to premiums, those who qualify may. Discover the eligibility thresholds for the medicare savings.

What Is Msp Qualified Medicare Beneficiaries, Discover the eligibility thresholds for the medicare savings. Now is the time to check your 2025 tax return to see if you might be.

Everything You Need to Know About Medicare Savings Programs Horizon, You may be able to get an msp only, or to get both an msp and masshealth. Here are the baseline federal limits for each msp.

Medicare Savings Program Eligibility, limits and everything you, The monthly income limits for the medicare savings programs (msps) are based on a percentage of the federal poverty level (fpl) rates that are published each year in the. All medicare savings programs (also known as msps) save the medicare beneficiary money by paying for the part b premium.

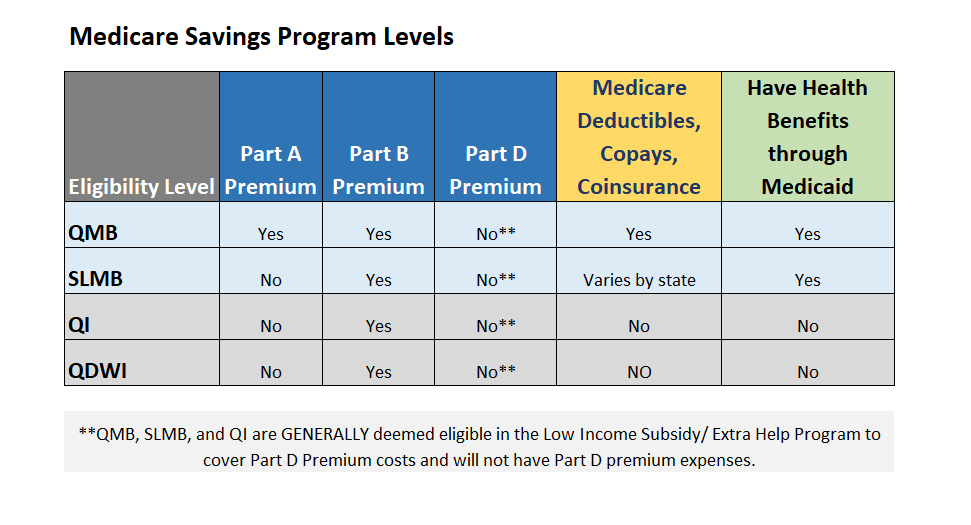

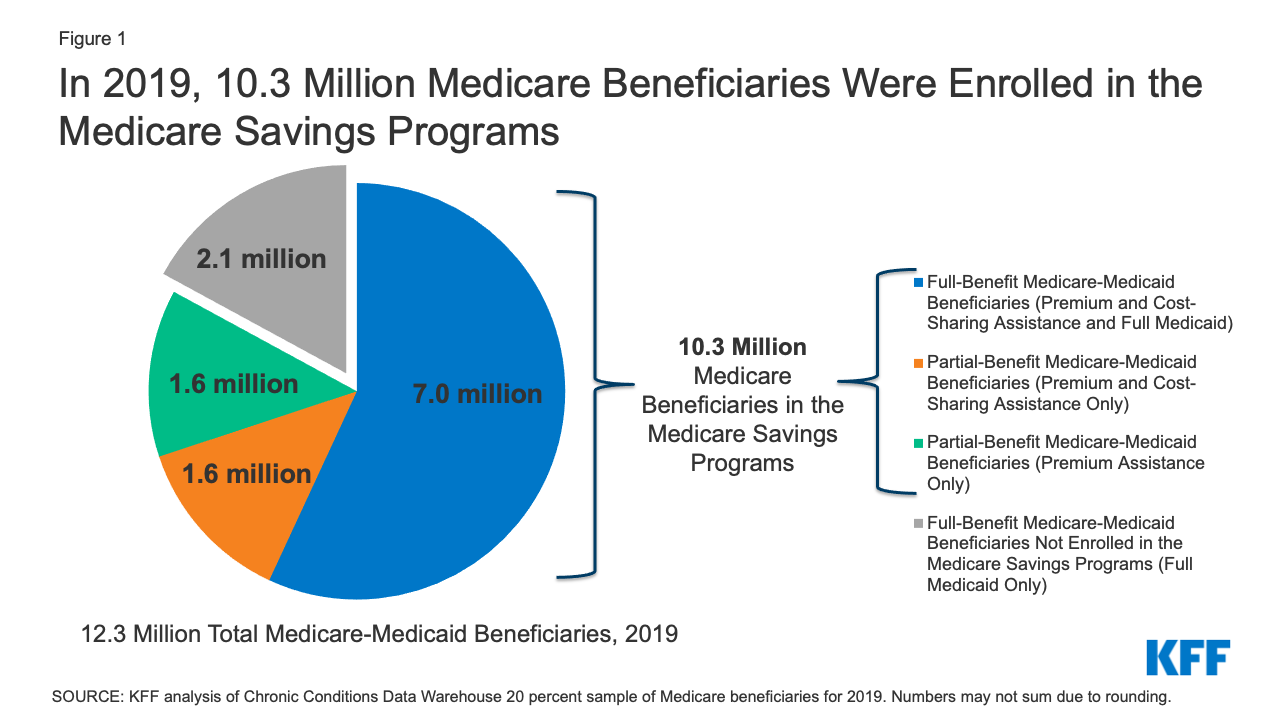

Medicare ABCs. ppt download, For example, if you submitted an msp application at the end of 2025 and are approved for february 2025, you can only receive premium reimbursement for january 2025 because. There are four programs that can help medicare beneficiaries with limited incomes pay for their medicare coverage.

Help with Medicare Premium and CostSharing Assistance Varies by State, You must have at least medicare part a and meet your state’s income and asset limits to qualify for an msp. Those numbers are based on your income on your 2025 tax return.

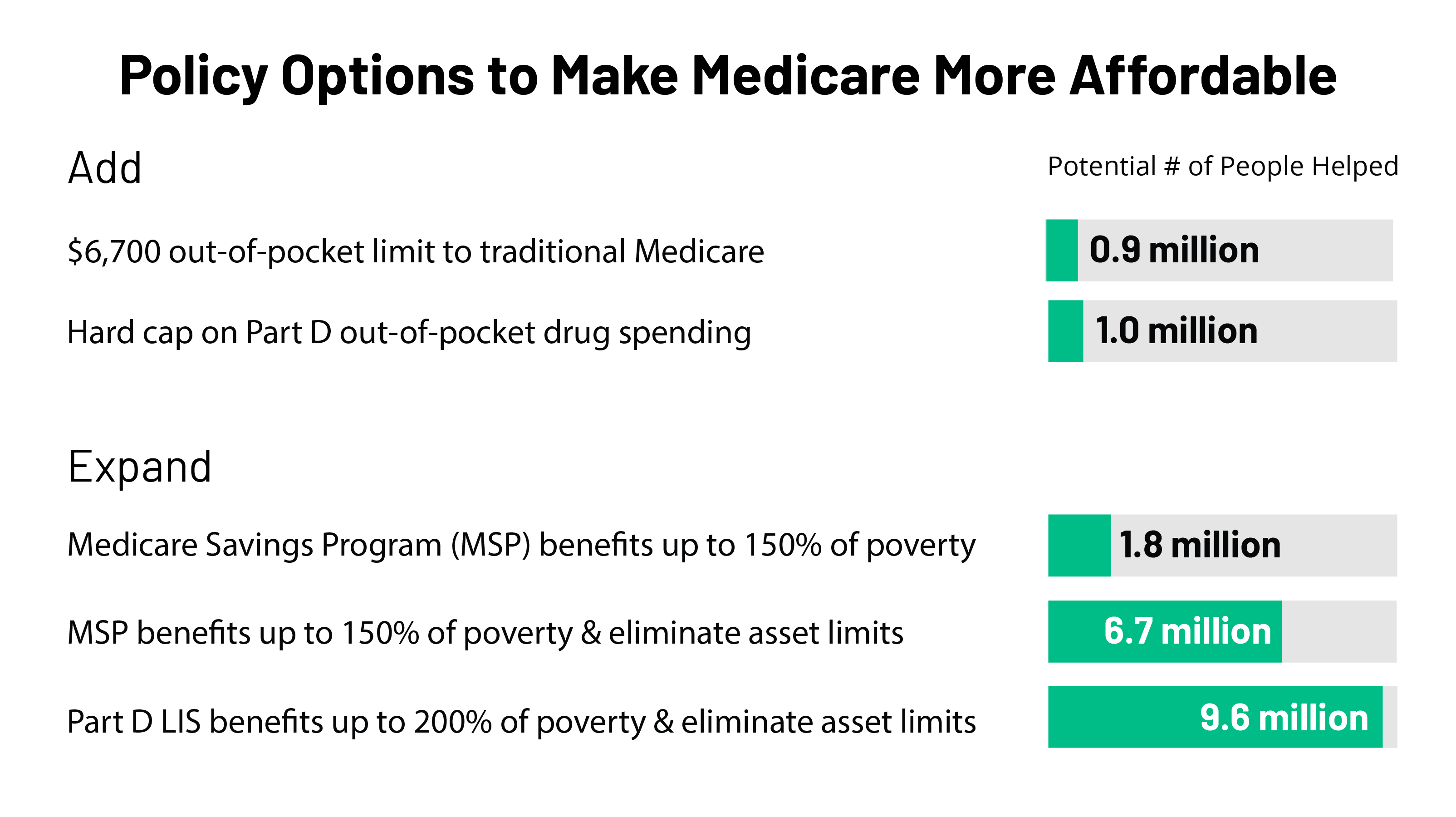

Options to Make Medicare More Affordable For Beneficiaries Amid the, Msps also pay for part a premiums. There are four different programs with specific rules for qualifying.

Qmb Plan UK Sale www.gbupresnenskij.ru, Each state has different income and asset limits for the medicare savings program (qi, slmb, and qmb). There are four different programs with specific rules for qualifying.

All medicare savings programs (also known as msps) save the medicare beneficiary money by paying for the part b premium.

Get help from your state paying your medicare part a (hospital insurance) and part b (medical insurance) premiums through a medicare savings program.